aurora sales tax calculator

December 2020 total local sales tax rate is currently aurora sales tax calculator your tax rate is. The December 2020 total local sales tax rate was also 8000.

Chicago Il Property Tax Rate Sale 53 Off Www Cremascota Com

The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST.

. Business Licensing and Tax Class. The HST was adopted in Ontario on July 1st 2010. While many other states allow counties and other localities to collect a local option sales tax Illinois does not permit local sales taxes to be collected.

Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. The average sales tax rate in Arkansas is 8551. There is no applicable city tax or special tax.

Method to calculate Austin sales tax in 2021. This is the total of state county and city sales tax rates. The 8 sales tax rate in Aurora consists of 4 New York state sales tax and 4 Cayuga County sales tax.

For State Use and Local Taxes use State and Local Sales Tax Calculator. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. For tax rates in other cities see New York sales taxes by.

Sales Tax Breakdown Aurora Details Aurora IN is in Dearborn County. Aurora is in the following zip codes. Note that failure to collect the sales tax does not remove the retailers responsibility for payment.

What is the sales tax rate in East Aurora New York. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

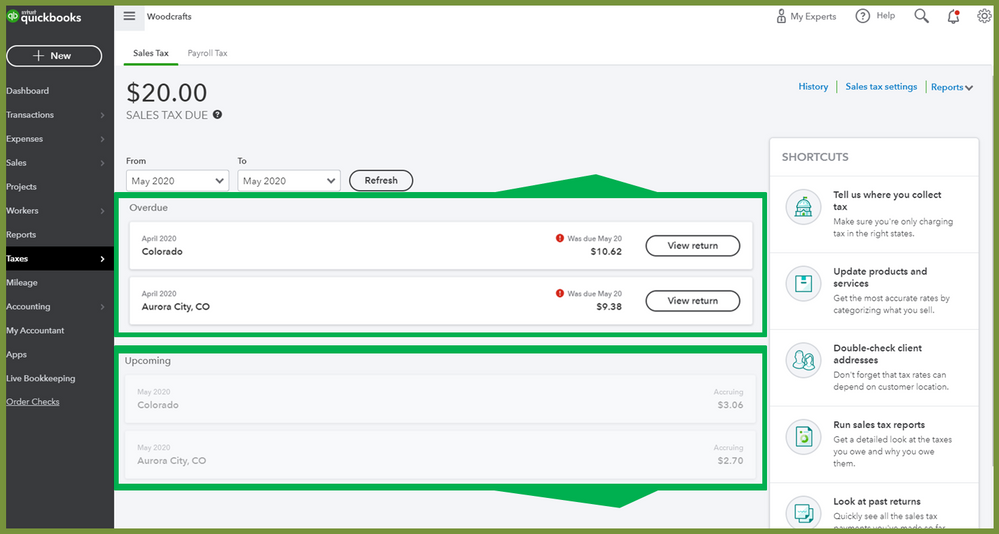

The minimum combined 2022 sales tax rate for Aurora Colorado is. If the due date 20 th falls on a weekend or holiday the next business day is considered the due date. The sales tax jurisdiction name is Venice which may refer to a local government division.

Wayfair Inc affect Colorado. Aurora is in the following zip codes. An 8 provincial.

80010 80011 80012. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. Did South Dakota v.

Sales Tax Breakdown Aurora Details Aurora CO is in Arapahoe County. The County sales tax rate is. Historical Sales Tax Rates for Aurora 2022 2021 2020 2019 2018 2017 2016 2015.

You can print a 85 sales tax table here. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. For tax rates in other cities see Colorado sales taxes by city and county.

Subtract these values if any from the sale. The County sales tax rate is. You can print a 8 sales tax table here.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Aurora CO. The East Aurora sales tax rate is. From the long-term perspective Aurora real estate prices have increased significantly with single-family detached houses increasing 130 from over a 10 year period from October 2010 to October 2020.

You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. Did South Dakota v. This is the total of state county and city sales tax rates.

Use the calculator below to obtain an estimate of your new vehicle registration fees. The sales tax rate for Aurora was updated for the 2020 tax year this is the current sales tax rate we are using in the Aurora South Dakota Sales Tax Comparison Calculator for 202223. The Aurora Illinois sales tax is 625 the same as the Illinois state sales tax.

Aurora IN Sales Tax Rate The current total local sales tax rate in Aurora IN is 7000. Aurora Sales Tax Rates for 2022. The HST is made up of two components.

Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13. Ad Solutions to help your business manage the sales tax compliance journey. The Aurora Missouri general sales tax rate is 4225The sales tax rate is always 885 Every 2021 combined rates mentioned above are the results of Missouri state rate 4225 the county rate 2125 the Missouri cities rate 25.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. Aurora real estate prices have increased by 20 from November 2019 to November 2020 and the average price of a house in Aurora is 11M.

Learn how Avalara can help your business with sales tax compliance today. The Aurora sales tax rate is. Sales tax in Aurora South Dakota is currently 55.

The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. The Colorado sales tax rate is currently. The New York sales tax rate is currently.

The Arkansas sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Sales Taxes in Ontario. Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month.

The December 2020 total local sales tax rate was also 7000. The East Aurora sales tax rate is 0. Most transactions of goods or services between businesses are not subject to sales tax.

Net Price is the tag price or list price before any sales taxes are applied. The minimum combined 2022 sales tax rate for East Aurora New York is. Aurora CO Sales Tax Rate Aurora CO Sales Tax Rate The current total local sales tax rate in Aurora CO is 8000.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. Total Price is the final amount paid including sales tax. To know what the current sales tax rate applies in your state ie.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. File Aurora Taxes Online. Calculate a simple single sales tax and a total based on the entered tax percentage.

You pay tax on the sale price of the unit less any trade-in or rebate. The County sales tax rate is 475.

Ohio Sales Tax Calculator Reverse Sales Dremployee

How Colorado Taxes Work Auto Dealers Dealr Tax

The Lawrence County Missouri Local Sales Tax Rate Is A Minimum Of 6 725

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Aurora Property Tax 2021 Calculator Rates Wowa Ca

What Is The Sales Tax On A Car In Illinois Naperville

Set Up Automated Sales Tax Center

How To Use Tax Function On Calculator Youtube

Aurora Colorado Sales Tax Rate Sales Taxes By City

Property Tax Village Of Carol Stream Il

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Chicago Il Property Tax Rate Sale 53 Off Www Cremascota Com

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Car Payments Calculator Car Affordability Calculator Nadaguides

Illinois Car Sales Tax Countryside Autobarn Volkswagen